Without the due diligence of a court order, the police instructed banks holding Nithyananda Dhyanapeetam Trust accounts to freeze them. All due to the invested parties who were against His Holiness Paramahamsa Nithyananda, the tremendous amount of good work that was in the works came to a sudden stand still. A big sigh of relief, when High Court of Karnataka passed the order lifting the freeze of the bank accounts of the trust.

18 June 2010

Without asking for the proper documentation, ICICI bank and other banks with which the Trust had charitable accounts froze all accounts and activity. Due to this, many people depending on the charitable services of the Trust began living dangerously in survival mode. The immense charitable work that His Divine Holiness Paramahamsa Nithyananda was doing was left without funds and had to stop their operations, temporarily.

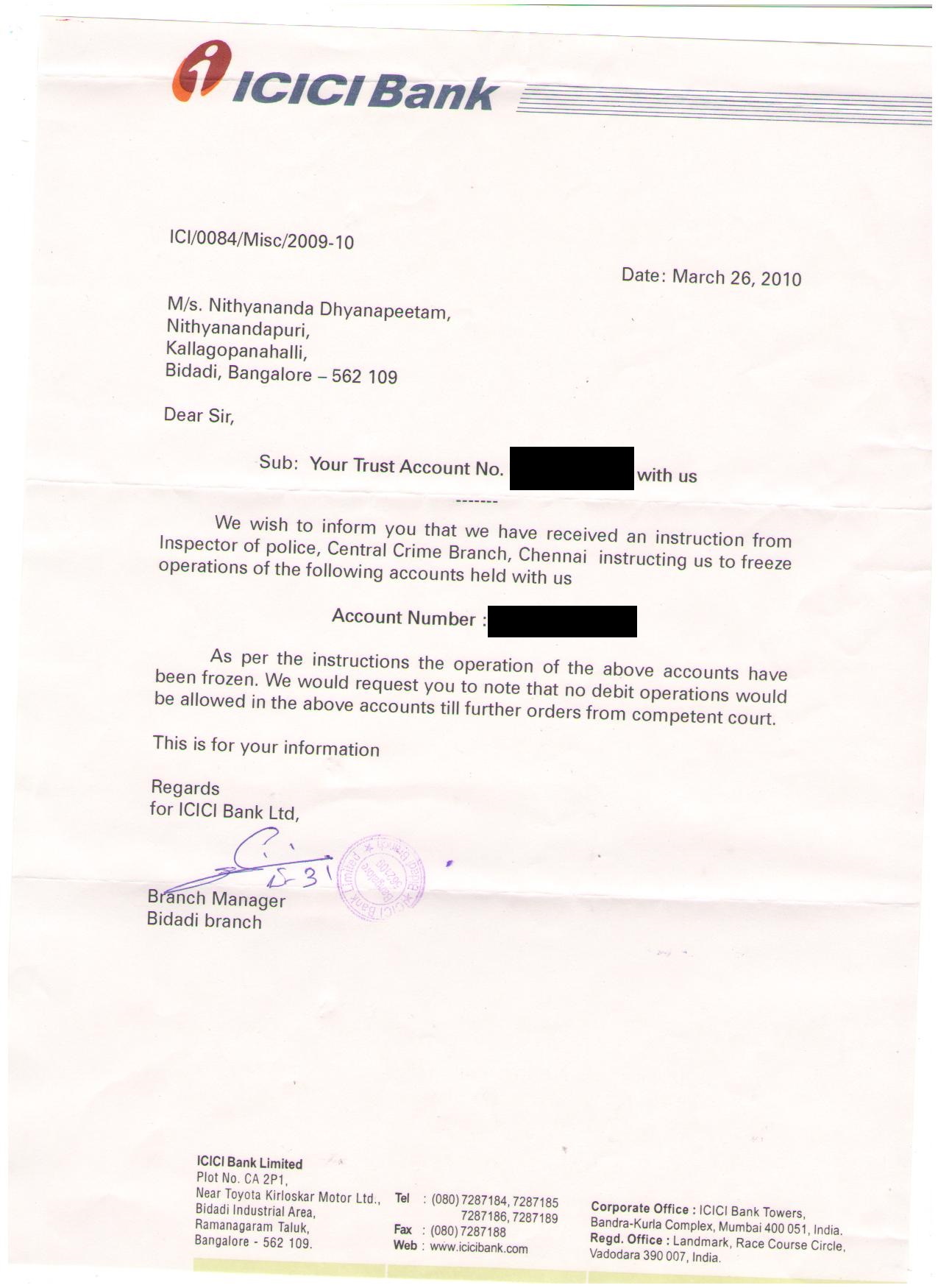

26 March 2010 – Bank accounts of the Public Charitable Trusts frozen

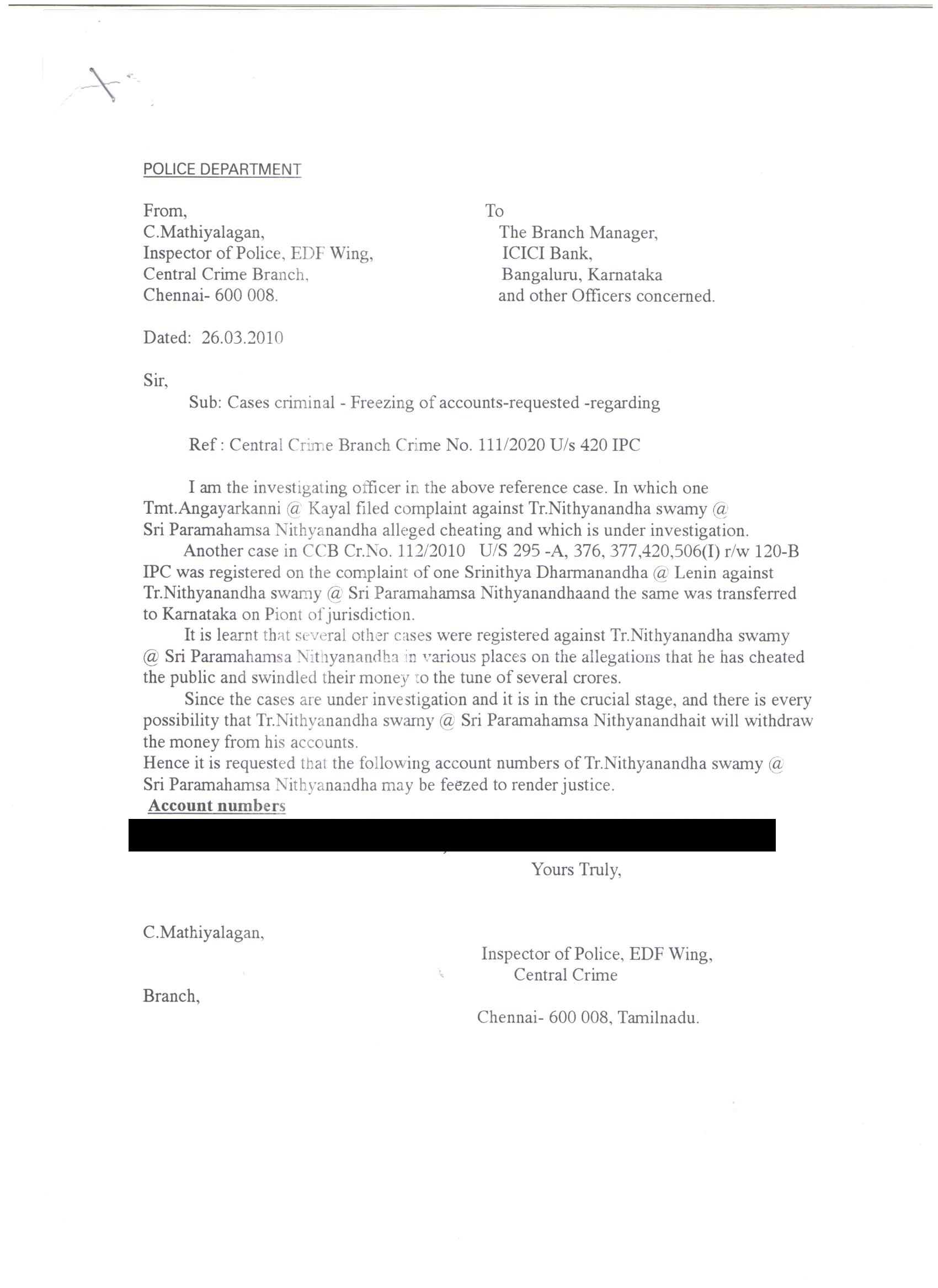

In the wake of the morphed video being made viral by Sun TV and related television networks, sent a communication to the banks in which the public charitable Trusts inspired by His Holiness Paramahamsa Nithyananda had kept the raised donations. The notice was to immediately freeze all the bank accounts of these Trusts. The notice in a sinister way refers to the accounts as the bank account of His Holiness Paramahamsa Nithyananda when in fact he has no personal bank account but these are accounts of the charitable Trusts inspired by him and run under his spiritual guidance.

The banks under direction from the police froze the bank accounts immediately with no intimation to the Trust which as per law they are obliged to do.

What rights did the police have to send such a communication to the banks holding the donations given by the devotees and followers to the public charitable Trusts? The bank accounts were of the Trusts, and had nothing to do personally with Paramahamsa Nithyananda. Was there any intimation or communication of the notice to freeze the bank accounts of the Trusts to the trustees of these Trusts? None.

Under Section 102 of the Code of Criminal procedure in India, the police have no power to seize or freeze bank account as it is not movable or immovable property. It is only for a Court of law to decide and that too when there is suspicion of the property being stolen. The police has no right whatsoever to arbitrarily freeze someone’s bank account.

This arbitrary and illegal act of the police brought all the activities of the public charitable Trusts to a standstill – the socio-spiritual services had to be stopped as there were no finances available. The sannyasis and full-time volunteers and residents of the ashram were left with no means to survive as they were suddenly deprived of the money needed for their food and day to day activities though they had every legal right of access to the same.

Effect of the 84 day bank freeze

The bank freeze which lasted for almost 84 days had a huge impact on social and charitable activities like

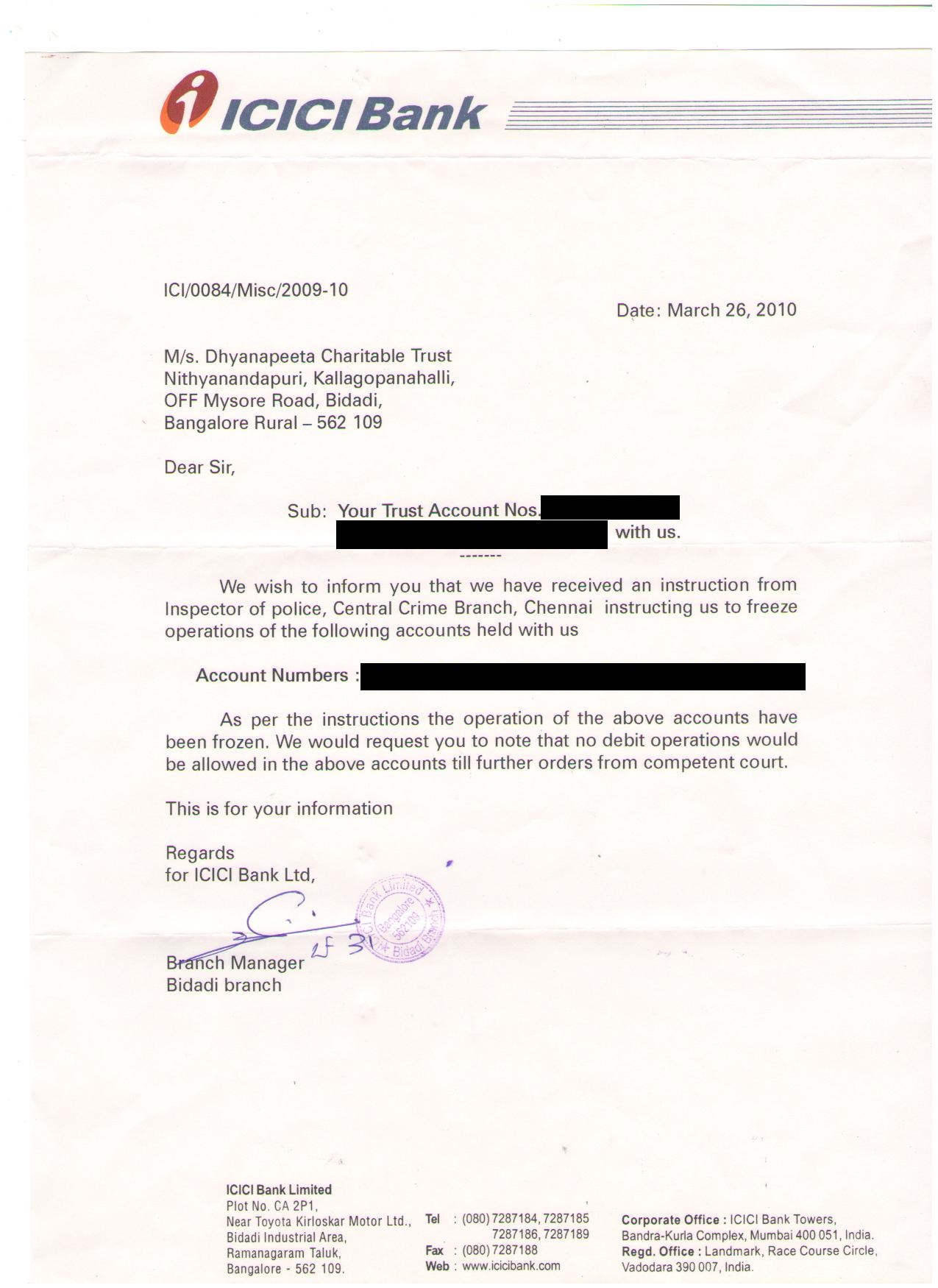

- Free Anna Daana (Spiritual Offering of Food)

- Free Medical Camps

- Temple revival

- Goshala (Dairies)

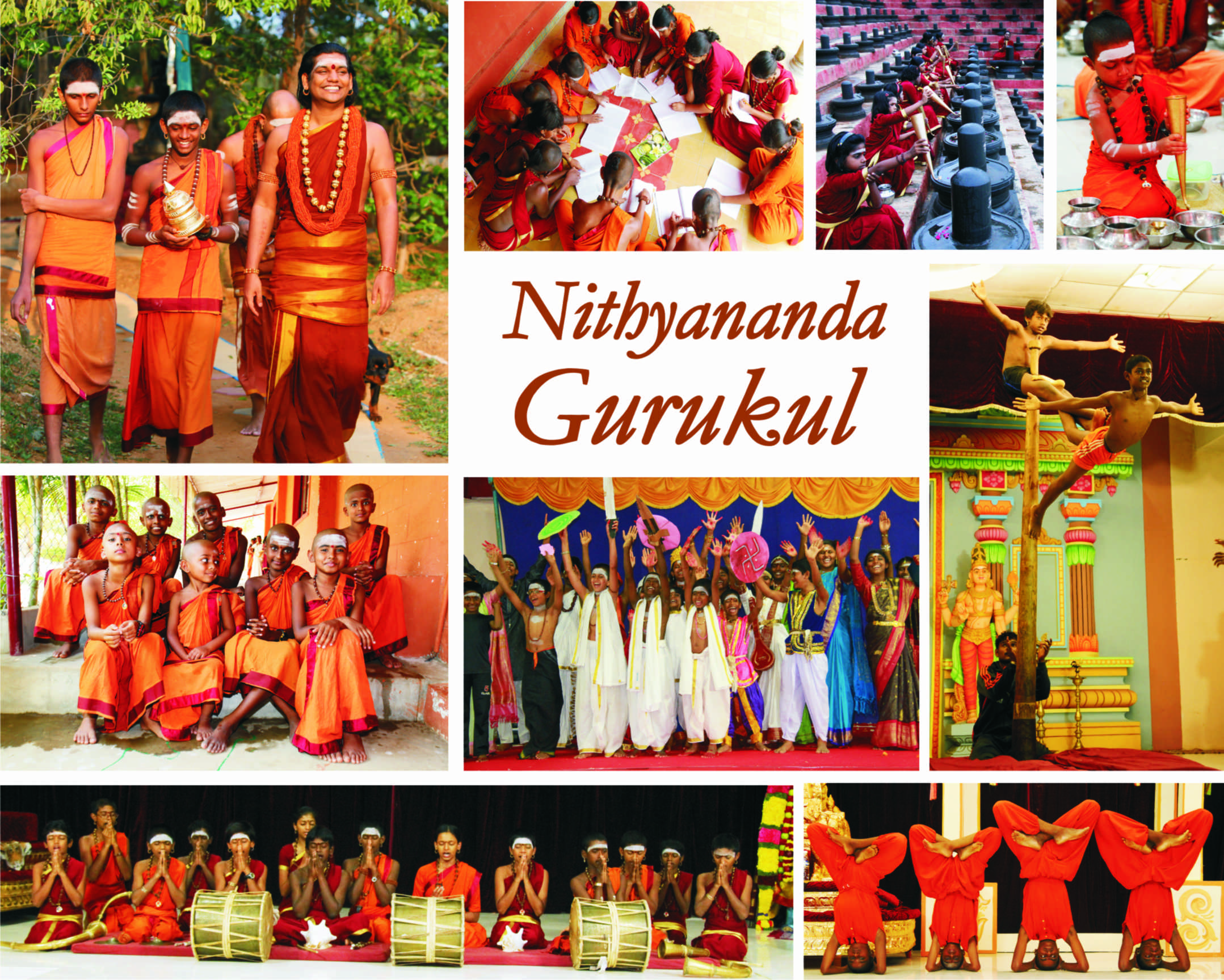

- Gurukul (traditional vedagamic schools)

Even the day to day livelihood was affected.

ICICI bank and other banks had frozen the various bank accounts of Dhyanapeeta Charitable Trust as well as other Trusts in March 2010. The ashramites (aadheenavasis) and sannyasis practised great austerity to reduce expenditure, even going to the extend of skipping meals. Inspite of all odds, by grace of Bhagwan SadaShiva and His Divine Holiness, Paramahamsa Nithyananda none of the spiritual activities or daily puja stopped.

Lord SadaShiva as Bhikshatana collects Bhiksha from one hand and distributes to everyone with the other. It is a spiritual process by which the asker of Bhiksha goes through completion with his ego, and the giver completes with his karmas by offering, and the society which receives (as free food, free medical services, free education) gets enriched!

Anna Daan

Free Medical Camps

Gurukul

Gurukul are our traditional vedagamic schools. All Nithyananda Gurukuls offer education completely free of cost.

On 18 June 2010, the High Court relieved the ashram from this illegality and removed the freeze on the bank accounts.

Summary of legal status related to defreeze of bank accounts

ICICI bank had frozen the various bank accounts of Dhyanapeeta Charitable Trust as well as other Trusts in March 2010. They claimed this was based on a letter received from Central Crime Branch, Chennai, dated 26-3-10 and from CID Bangalore dated 29-4-10. There was no court direction and the accounts were frozen with no prior notification. In fact, the account holder / trustee had to request for the reason why the accounts were frozen, by a letter dated 3-5-10. In response, ICICI bank gave a reply dated 5-5-10 that all the accounts have been frozen as per directions from police.

Writ Petition 15873/2010 was filed by Dhyanapeeta Charitable Trust against this freeze of accounts by ICICI bank.

The High Court of Karnataka had to dismiss as withdrawn the case as the Additional Advocate General requested to withdraw the case on behalf of the State.

Dhyanapeeta Charitable Trust is a registered Public Charitable Trust formed for charitable purposes and has been serving the public at large through free food, free medical camps, free spiritual counselling, free meditation and yoga camps to people from all socio-economic sections of the society. The Trust has maintained its accounts thoroughly and submitted the same by filing its income tax returns appropriately on time.

Suddenly on 5.5.2010, the Trust members realized to their shock that ICICI bank with whom the Trust had kept its public donations for many years, suddenly froze the public money with no notification arbitrarily in complete violation of the law.

Section 102 of the Code of Criminal Procedure clearly states its ambit to be:

- Reasonable suspicion of being a stolen property

- Report to the Superior Officer and

- Report to the magistrate having jurisdiction to deal with the seized property

None of these mandatory provisions were applicable in the case of the Trust.

The Trust was neither given any notice freezing or rather seizing the bank account, nor was any report as contemplated under sub section 3 of Section 102 of the Code submitted or made before the Magistrate.

ICICI Bank arbitrarily and illegally froze the Trust bank account. The bank does not have the power to freeze the account as the money in the bank account cannot be the property within the meaning of Section 102 of the Code. Property which is capable of being disposed off under Section 452 of the Code of Criminal Procedure at the conclusion of the trial only can be subject matter of seizure under Section 102 of the Code of Criminal Procedure.

A bank account is neither a movable nor an immovable property. Once a person puts money into his account in a bank, the same becomes the property of the bank and that money cannot be found in specie or in tangible form. The money ceases to be the property of the person and he merely becomes a creditor, the bank being a debtor. Such a person has only an actionable claim and he has power to draw equivalent amount of money from the bank which is nothing more than a “chose in action”. Such money being incapable of being seized in specie, ceases to be tangible and, therefore, cannot be seized under the provisions of Section 102 of the Criminal Procedure Code. The Bank has no right to freeze the Account and not to allow the Account holders to operate the same.

The provisions of the Criminal Law (Amendment) Ordinance 1944 and the provisions of Chapter VII-A of Criminal Procedure Code clearly show that whenever the Legislature wanted to make provisions for seizure or attachment of immovable property, Bank Accounts and even the property which is converted from illegal gains by the accused, specific provisions have been made providing special procedure. However, in all such cases, the power is given only to the Court.

The power under Section 102 is of a summary and emergent nature. It is only when the property is alleged or suspected to have been stolen or which may be found under circumstances, which creates suspicion of the commission of any offence that the property can be seized. The word “seize” used in Section 102 means actual taking possession in pursuance of a legal process. Thus prohibiting a Bank with which the Trust has a account, not to pay any amount out of the Account to the Trust cannot be seizure or freezing of Account as contemplated under Section 102 of the Code. Seizure under Section 102 of the Code is an act of taking possession of the property in fact and that too in pursuance of a legal procedure and as such not allowed to be taken arbitrarily by the Bank.

And it also not the case that the Trust Bank accounts were traced or discovered under circumstances, which have created any suspicion of the commission of any offence or fraud. So the seizure of the Bank accounts was wrongful and illegal.

The series of Accounts which were seized are without any nexus to any crime alleged. The seizure of all the Accounts was done without even informing the Account holder i.e. the Trust and having proper order of the Court to do the same. The Trust was not even supplied with the copy of the order which empowered the Bank to freeze the said accounts. It was only after the Trust applied for the letter that it received a copy of the same.

Maintaining the Public Trust accounts with the donations raised and running its activities is a fundamental right of the Trust. Further the complaint is not made by any person who is either directly or indirectly affected by the functioning of the Trust.

The Trust had the responsibility of running its schools, gurukuls, ashrams, meditation and yoga centers, goshalas and maintaining them. There were hundreds of sannyasis, disciples, devotees, living in and running these various socio-spiritual initiatives from the ashrams. So there was a need for regular funds for basic survival, maintenance and upkeep of the ashrams.

Since the Bank accounts were frozen, the Trust was put to great difficulties and was put to great hardship for basic survival of the people and other beings like cows of the goshala. The basic right to life was taken away from the thousands of people supported by the Trust and having the Trust as the only means to get basic food, clothing and shelter.

Even if one were to by some stretch of imagination assume that Swami Nithyananda who was framed in a false case were really guilty, this still doesn’t empower the Bank to touch the Bank accounts of the Public Charitable Trust in which he was just one of the Trustees.

The money held in the account of the Trust is not his personal money but the interest of the innumerable devotees and donors who had given money for supporting the charitable activities of the Trust. The Trust and its devotees have a fundamental right to conduct the day to day activities without any hindrance from the Bank and their rights are fundamentally protected by the Article 26 of the Constitution of India.

In the previous case of Sri Kanchi Kamakoti Sri Shankaracharya Swamigal Srimatam Samsthanam vs the State of Tamil Nadu and others, in Writ Petition No. 1050 of 2005 the Court has ruled:

“44. The scope and applicability of Section 102 of Cr.P.C. is under rare and exceptional circumstances and is to be applied only to the assets of the accused, which are the direct outcome of the Mutt which is an institution unconnected with the offence. The power which is vested for a particular purpose cannot be stretched to irrelevant matters and to extremes and to a breaking point, in the event of which, the Court is compelled to interfere. Discretion to use the power should be used and exercised cautiously, failing which it becomes misuse of discretion and tainted with arbitrariness.

- The Mutt is an organization of religious faith of innumerable people. So also is the Church, Mosque, Wakf, etc. there are several Endowments, trusts and philanthropic activities attached to these organizations over which several devotees have personal interest, faith and sentimental devotion. One may or may not agree with the respective faith or belief of others. But they have a right to establish and maintain institutions for religious and charitable purposes within the framework of law and such right is granted as a fundamental right under the Constitution vide Article 26, such an organization cannot be paralyzed or closed down virtually by sending a letter purporting to act under Section 102 of Cr.P.C., only for the reason that the Head of the Mutt and few office bearers are alleged to be involved in some offences…”

On 18th June 2010, the Hon’ble High Court of Karnataka passed the order in WP 15873/2010 lifting the freeze of the bank accounts of the Trust as the government itself put forth that it had done a mistake by ordering the freezing of the bank accounts.